Last week I was speaking in Antwerp at the 5th Eurhistock Workshop (programme here). My posts this week will briefly survey some papers which were presented at this conference. However, in this post I want to discuss the purpose and usefulness of financial history. Why should we be interested in financial history?

Reason 1: Financial history provides long run data for tests of asset pricing theories (see Dimson, Marsh and Staunton's Investment Returns Yearbook).

Reason 2: Financial history provides out-of-sample tests and natural experiments of asset pricing (see Koudijs, 'The boats that did not sail').

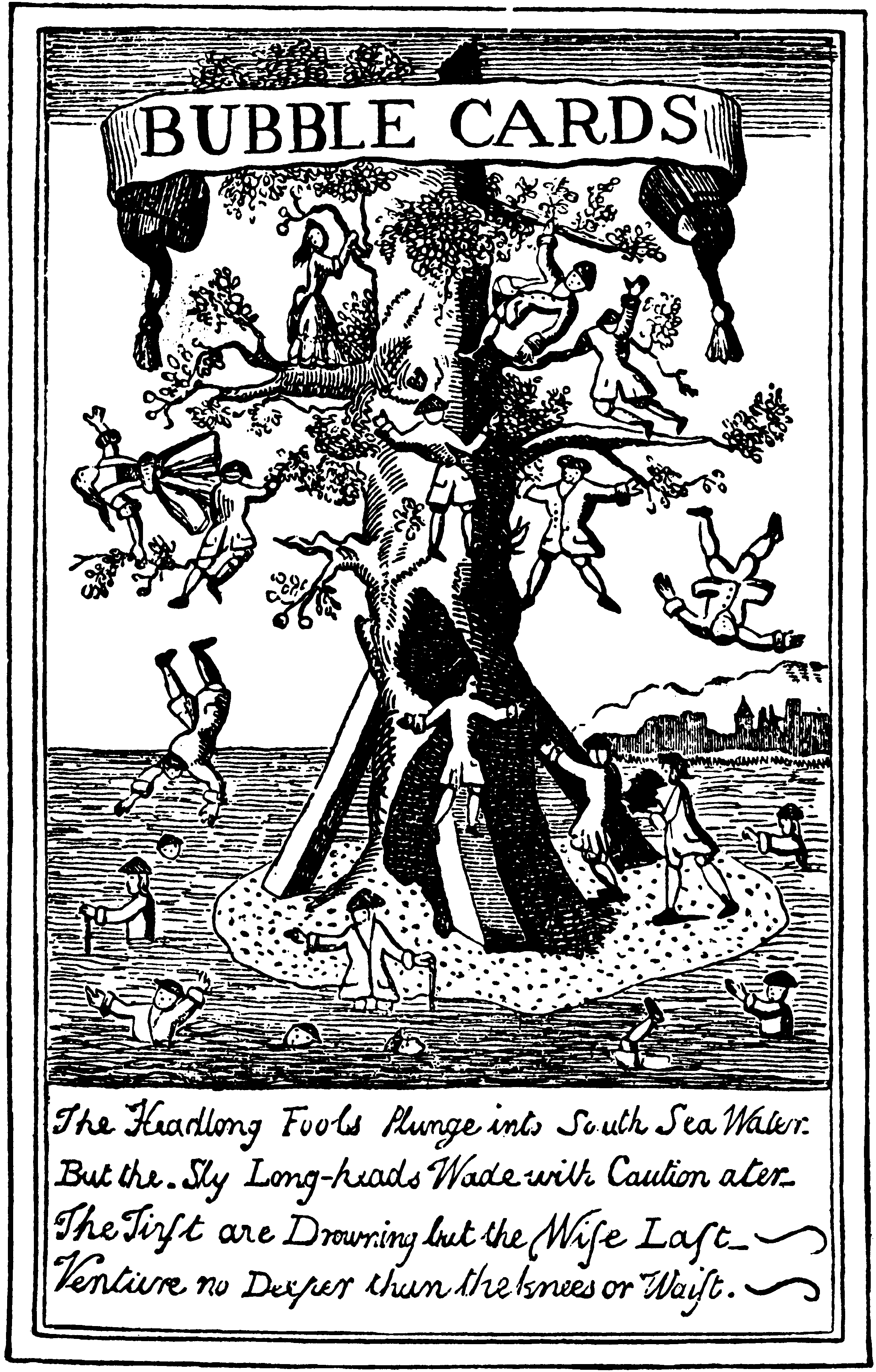

Reason 3: Financial history allows us to test economic theories of bubble formation (see Garber's 'Famous first bubbles').

Reason 4: Financial history enables us to test corporate finance theories in an era when tax and regulatory distortions did not exist (see my paper with Ye and Zhan on dividend policy in C19th)

Reason 5: Financial history gives us insights into the fundamental features of capital markets and the modern corporation.