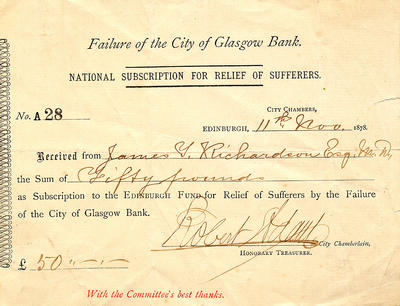

The final report from the Parliamentary Commission on Banking Standards has just been published. A summary of the report and its main recommendations is available here and the full report is available here. One of the recommendations in the report is that bankers should face prison for their reckless mismanagement of banks - click here for the BBC's coverage of this story. But should bankers be jailed for reckless risk-taking? A lesson from financial history proves helpful here.

The last major UK bank to be allowed to fail was the City of Glasgow Bank in October 1878. This bank was one of the largest in the UK at the time. Shortly after its collapse, the bank's manager, secretary and directors were arrested. At their trial,

Robert Stronach, the bank’s general manager, and Lewis Potter, one of the

bank’s directors, were found guilty of falsifying the bank’s balance-sheets;

they were given an 18-month prison sentence. Five other directors

were found guilty of publishing balance sheets which they knew to be false,

and, as a result, were imprisoned for 8 months. These bankers were reckless, but they also engaged in fraud by publishing false information to shareholders. It was for their fraud that they were jailed not their reckless risk-taking.

We still have laws which can result in fraudulent directors being sent to jail. Bankers should be sent to jail for fraudulent behaviour not reckless risk-taking. Sometimes, of course, there may be a fine line between fraud and recklessness.